43 yield of zero coupon bond

How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: When solved, this equation produces a value of 0.03975, which would be rounded and listed as a yield of 3.98%. Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = Example 1. Consider a 30-year zero-coupon bond with a face value ... Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds For bonds with multiple coupons, it is not generally possible to solve for yield in terms …

Yield of zero coupon bond

Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a 20 ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. As coupon rates are fixed in terms of yearly interest payments, that’s why it is necessary to divide the rate by two, to have the semi-annual payment.

Yield of zero coupon bond. Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds … Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 The yield to maturity on one-year zero-coupon bonds | Chegg.com The yield to maturity on one-year zero-coupon bonds is 8.9%. The yield to maturity on two-year zero-coupon bonds is 9.9%. Required: a. What is the forward rate of interest for the second year? (Do not round intermediate calculations. Round your answer to 2 decima places.) b.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068. What Is a Zero Coupon Yield Curve? - Smart Capital Mind The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%.

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. How to Calculate Yield to Maturity of a Zero-Coupon Bond When solved, this equation produces a value of 0.03975, which would be rounded and listed as a yield of 3.98%. Time value of money (TVM) formulas usually require interest rate figures for each... Bond Yield: Formula and Percent Return Calculation - Wall Street … Calculating the current yield of a bond is a three-step process: Step 1: The current bond price can be readily observed in the markets – in which the bond can either trade at a discount, at par or at a premium to par.; Step 2: The annual coupon is a function of the bond’s coupon rate, par value, and payment frequency – and, if applicable, the coupon rate must be annualized.

NASDAQ - Datastore NASDAQ - Datastore

The current zero-coupon yield curve for risk-free | Chegg.com Question: The current zero-coupon yield curve for risk-free bonds is as follows: What is the price per $100 face value of a four-year, zero-coupon, risk-free bond? The price per $100 face value of the four-year, zero-coupon, risk-free bond is? (Round to the nearest cent.)

Domestic bonds: Japan, Bills 0% 20feb2023, JPY (1120, 98D) New issue: Issuer Japan issued bonds (1118) in the amount of JPY 5999900 mln maturing in 2023: 01/11/2022: New issue: Issuer Japan issued bonds (04420042) with the coupon rate of 0.005% in the amount of JPY 2953500 mln maturing in 2024: 27/10/2022: New issue: Issuer Japan issued bonds (1117) in the amount of JPY 5999950 mln maturing in 2023

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Yield Curve - The Thai Bond Market Association 1. The above yields are based upon average bids quoted by primary dealers, after 15% data cut-off from top and bottom when ranked by value. 2. Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields. 3.

Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield).

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ...

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

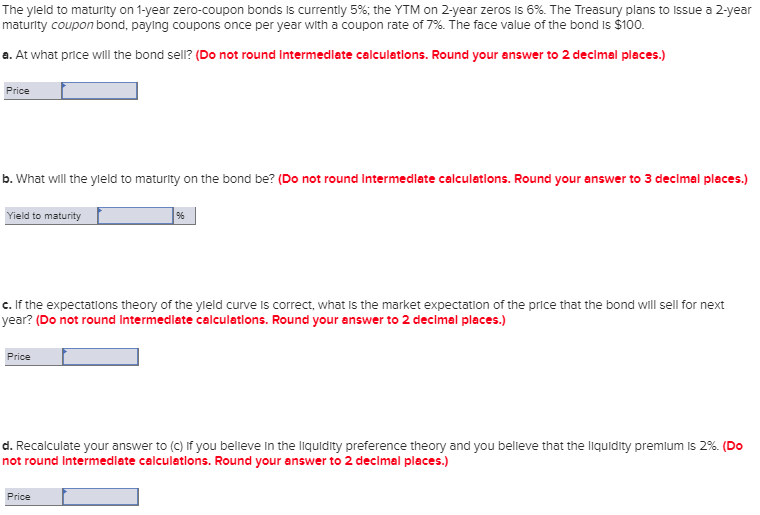

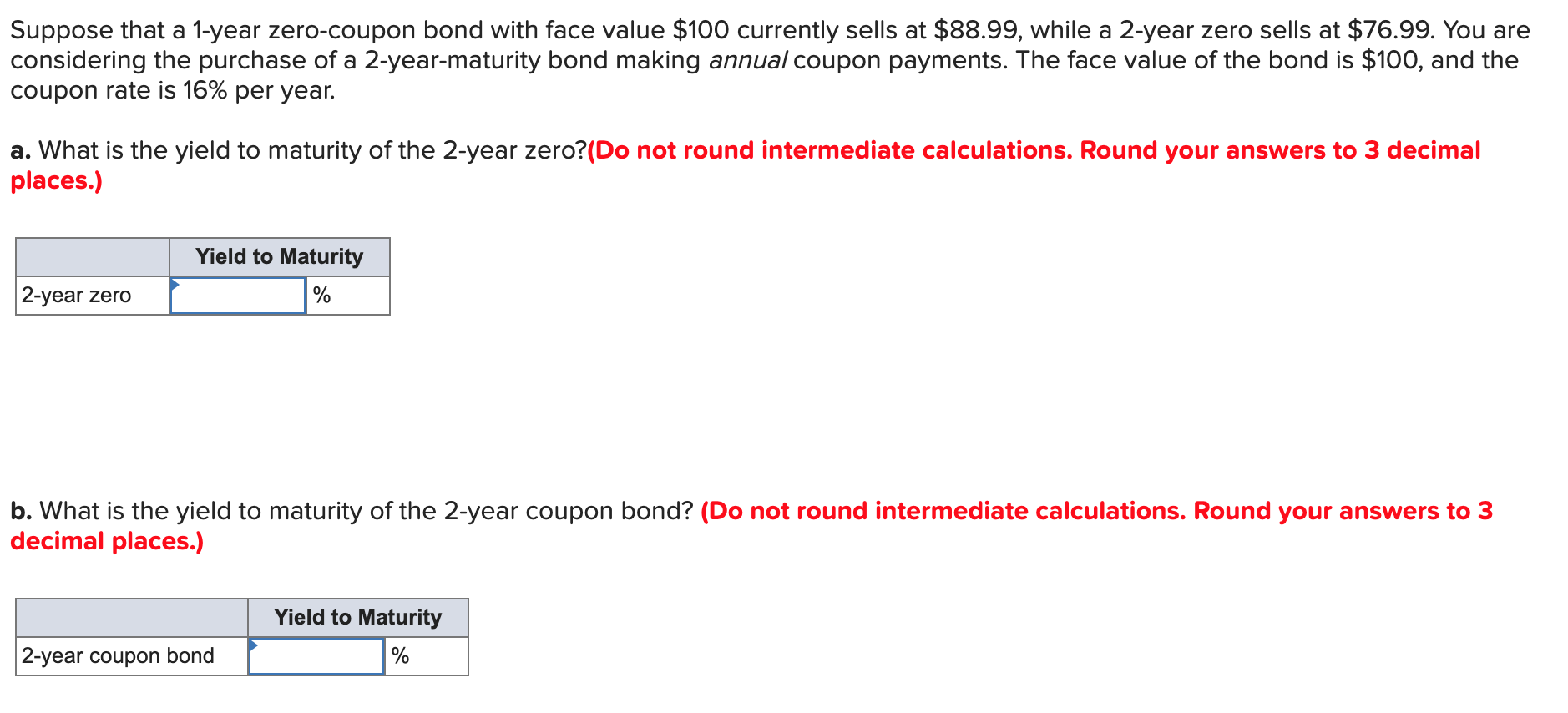

Solved The yield to maturity on 1-year zero-coupon bonds is | Chegg.com The yield to maturity on 1-year zero-coupon bonds is currently 6%; the YTM on 2-year zeros is 7%.The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 8.5%.The face value of the bond is $100.a.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

[Solved] Prices of zero-coupon bonds reveal the following pattern of ... In addition to the zero-coupon bond, investors also may purchase a 3-year bond making annual payments of $60 with par value $1,000. a. What is the price of the coupon bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What is the yield to maturity of the coupon bond? (Do not round intermediate calculations.

How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical bonds a great source of …

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. As coupon rates are fixed in terms of yearly interest payments, that’s why it is necessary to divide the rate by two, to have the semi-annual payment.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a 20 ...

Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/14-Figure3-1.png)

Post a Comment for "43 yield of zero coupon bond"